A Comprehensive Guide to Project Management Contracts: Public, Private, and FIDIC Agreements

Introduction :

In project management, selecting the right contract type is a critical decision that impacts risk allocation, financial stability, project execution, and legal responsibilities. Whether managing a public or private project, national or international, understanding different contract structures is essential to ensuring a smooth and efficient workflow.

This guide provides a high-quality, in-depth overview of all major contract types, including traditional, public sector, and FIDIC contracts.

📜 1. Fixed-Price Contracts (Lump Sum Contracts)

🔹 Definition:

A contract where the contractor agrees to complete the entire project for a pre-determined total price. Payments are typically made based on project milestones.

✅ Advantages:

✔️ Predictable project costs for the client.

✔️ Simplifies contract administration and budgeting.

✔️ Reduces financial risks for the client.

❌ Disadvantages:

❌ High risk for the contractor if actual costs exceed estimates.

❌ Less flexibility for changes in scope.

📌 Best Used For: Small to medium-sized projects with well-defined scope (e.g., residential buildings, commercial offices, public sector projects).

📜 2. Unit Price Contracts (Measure & Pay Contracts)

🔹 Definition:

The contract divides the project into individual work units, each with a fixed price (e.g., cost per square meter, per ton of material, per cubic meter of excavation).

✅ Advantages:

✔️ Flexibility in quantity estimation.

✔️ Useful when the scope is partially defined but may vary.

✔️ Fair pricing for both parties as payment is based on actual work completed.

❌ Disadvantages:

❌ Can lead to budget overrunsif actual quantities exceed estimates.

❌ Requires detailed measurement and tracking of work units.

📌 Best Used For: Infrastructure and civil engineering projects (roads, highways, pipelines, excavation, earthworks).

📜 3. Cost-Plus Contracts (Reimbursable Contracts)

🔹 Definition:

The contractor is reimbursed for actual project costs plus an additional fee or percentage for profit.

📌 Common Variants:

- Cost-Plus-Fixed-Fee (CPFF): The contractor receives a fixed profit regardless of project cost.

- Cost-Plus-Incentive-Fee (CPIF): The contractor gets a bonus for meeting specific goals (e.g., completing early, reducing costs).

- Cost-Plus-Award-Fee (CPAF): A performance-based fee, where the contractor earns additional payments based on client evaluation.

✅ Advantages:

✔️ Suitable for complex projects with high uncertainty.

✔️ Encourages quality workas costs are covered.

✔️ Allows early project initiation, even if full details are not finalized.

❌ Disadvantages:

❌ Higher financial riskfor the client.

❌ Potential for cost overruns if expenses are not controlled.

📌 Best Used For: Large, complex projects with unknown variables (defense, research and development, emergency reconstruction).

📜 4. Guaranteed Maximum Price (GMP) Contracts

🔹 Definition:

A cost-plus contract with a ceiling price that cannot be exceeded. If costs go beyond the agreed maximum, the contractor must cover the extra expenses.

✅ Advantages:

✔️ Provides budget controlfor clients.

✔️ Incentivizes contractors to manage costs efficiently.

❌ Disadvantages:

❌ Contractors add risk premiums, making the initial contract price higher.

❌ Limits flexibility for project scope changes.

📌 Best Used For: Projects where costs are uncertain but must stay within budget (hospitals, government facilities, corporate headquarters).

📜 5. Design & Build (D&B) Contracts

🔹 Definition:

The contractor is responsible for both the design and construction phases of the project.

✅ Advantages:

✔️ Faster project completion (fewer handovers).

✔️ Reduces client coordination efforts.

✔️ Encourages innovative solutions.

❌ Disadvantages:

❌ Less client control over the design phase.

❌ Higher initial costs.

📌 Best Used For: Large infrastructure projects (stadiums, airports, bridges, high-tech buildings).

📜 6. Turnkey Contracts

🔹 Definition:

The contractor delivers a fully operational facility, ready for immediate use by the client.

✅ Advantages:

✔️ Minimal client involvementduring execution.

✔️ Less risk for the client in managing construction complexities.

❌ Disadvantages:

❌ Expensive for clients due to the comprehensive service.

❌ Minimal flexibility in design modifications.

📌 Best Used For: Factories, power plants, industrial complexes, IT data centers.

📜 7. Public-Private Partnership (PPP) Contracts

🔹 Definition:

A collaboration between the government and a private company to fund, build, and operate infrastructure projects.

✅ Advantages:

✔️ Reduces public sector financial burden.

✔️ Brings private-sector efficiency to public projects.

❌ Disadvantages:

❌ High legal and financial complexities.

❌ Potential misalignment between profit motives and public interest.

📌 Best Used For: High-cost infrastructure projects (highways, railways, airports, public utilities).

📜 8. FIDIC Contracts (International Standard Construction Contracts)

FIDIC (Fédération Internationale des Ingénieurs-Conseils) contracts are internationally recognized for construction and engineering projects.

🔹 Key FIDIC Contract Types:

🔴 Red Book (Construction Contract – Unit Price or Lump Sum) → Used for traditional construction projectswhere the client provides the design.

🟡 Yellow Book (Design & Build Contract) → Used when the contractor is responsible for both design and execution.

🟢 Silver Book (Turnkey EPC Contract) → For high-risk projects where the contractor bears all responsibilities.

🔵 Gold Book (PPP – Operation & Maintenance Contract) → Designed for long-term contracts involving operation and maintenance.

⚫ Green Book (Simplified Contract – Small Projects) → Used for low-risk, simple projects.

🟣 Emerald Book (Underground & Tunnel Works Contract) → Tailored for tunnel and geotechnically complex projects.

🎯 How to Choose the Right Contract?

The ideal contract depends on:

✅ Risk allocation(who takes the most risk?).

✅ Project complexity(well-defined or uncertain?).

✅ Client control needs(fixed specs vs. flexible design).

✅ Budget constraints (fixed price vs. cost-plus).

👉 Need expert guidance? Choosing the right contract ensures smoother execution, cost control, and legal clarity. 🚀

💬 What type of contract do you use most?Share your insights in the comments below!

Our latest articles

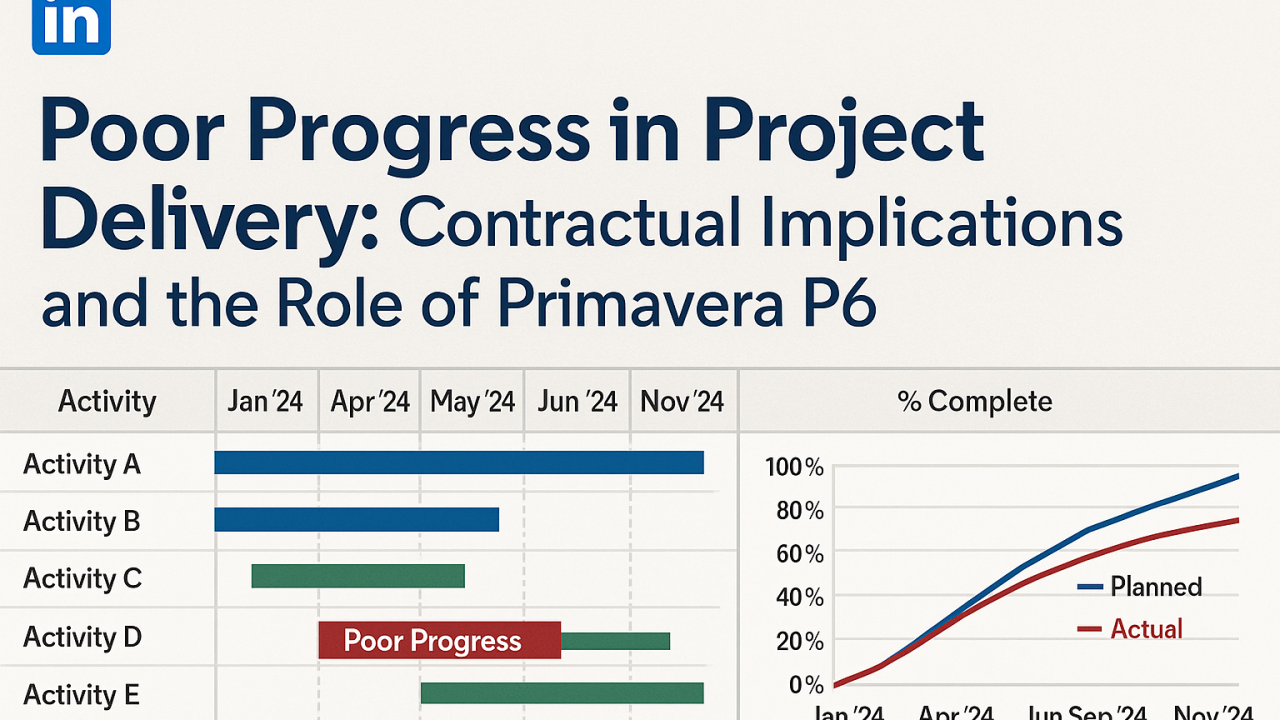

Poor Progress in Project Delivery: Contractual Implications and the Role of Primavera P6

Poor Progress in Project Delivery: Contractual Implications and the Role of Primavera P6 Introduction : In complex projects—especially in engineering,…

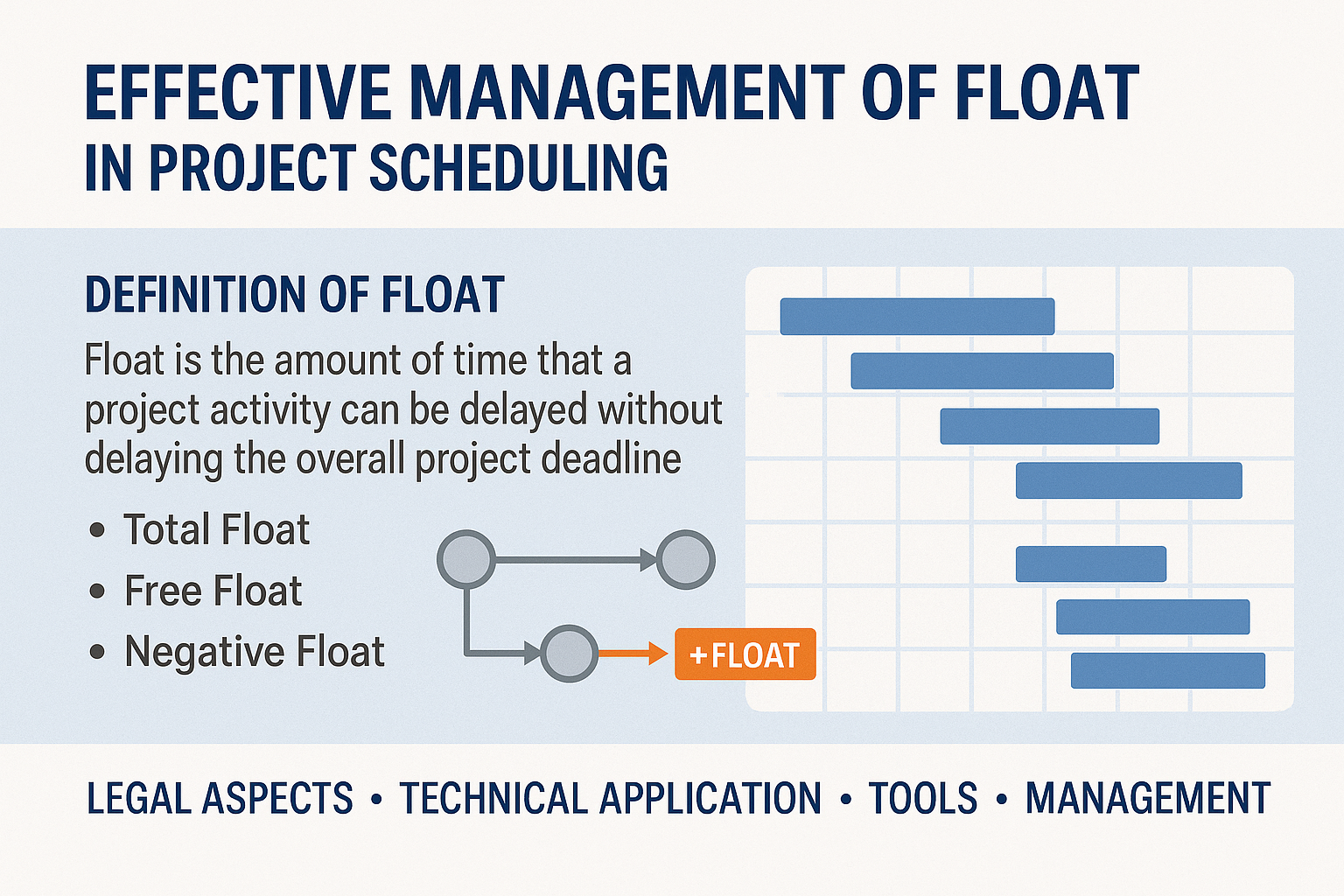

Effective Management of Float in Project Scheduling: Definition, Legal Aspects, Technical Application, and Tools

Effective Management of Float in Project Scheduling: Definition, Legal Aspects, Technical Application, and Tools 1. Introduction : In project management,…

5 Common Pitfalls That Lead to Construction Claims

5 Common Pitfalls That Lead to Construction Claims Introduction : In complex construction projects, claims are not merely a risk…